The IRS will start sending monthly payments from the new 3000 child tax credit in July to families who have proven eligibility by filing a 2020 tax return. Length of residency and 7.

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

To be eligible to claim the child tax credit your child or dependent must first pass all.

What is the child credit for 2020. Child Tax Credit 2020. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. For parents to take the credit the child must be 16 years old or younger at the end of the tax year.

This is a tax credit which means it reduces your tax bill dollar-for-dollar which makes it highly valuable for all families. At a basic level the child tax credit is a credit that parents and caregivers can claim to help reduce their tax bill depending on the number and ages of their dependents. If you have a small tax bill or dont owe any taxes at all you can receive up to 1400 of the Child Tax Credit as a refund as long as you meet the minimum income requirement.

Government effort to help families deal with the financial hardships stemming from the pandemicHeres what you should know about this federal program. The child tax credit refund is equal to 15 of qualifying earnings above 2500. If you have children or other dependents under the age of 17 you likely qualify for the Child Tax Credit.

Child Tax Credit Married filing jointly Single head of household qualifying widower 2000. For tax year 2020 The CAA allows taxpayers to use their 2019 earned income if it was higher than their 2020 earned income in calculating the Additional Child Tax Credit ACTC as well as the Earned Income Tax Credit EITC. For 2020 and beyond as much as 1400 of this credit is refundable.

Since this is not a deduction you can treat it as cash. For 2020 the maximum amount of the credit is 2000 per qualifying child. Your income can reduce this amount.

1 But this doesnt necessarily mean that all qualifying taxpayers will receive that much. In addition the qualifications for the child tax credit have broadened meaning more families can now qualify that previously could not. And previously the Child Tax Credit was only refundable if you filed for the Additional Child Tax Credit.

The maximum amount of the child tax credit per qualifying child. As pointed out by the Tax Policy Center because of. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements.

The Additional Child Tax Credit or ACTC is a refundable credit that you may receive if your Child Tax Credit is greater than the total amount of income taxes you owe as long as you had an earned income of at least 2500. This is a significant increase. Both the Child Tax Credit and the Additional Child Tax Credit phase out for high-income taxpayers.

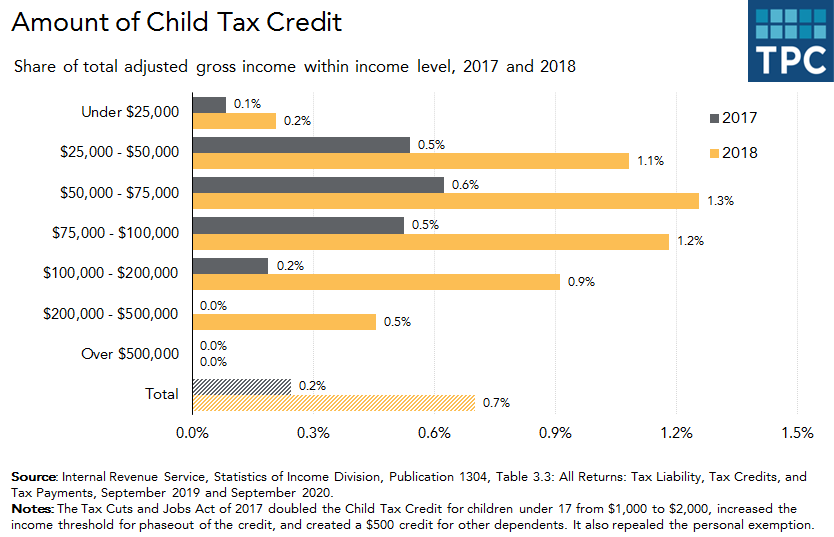

The TCJA increased the maximum Child Tax Credit to 2000 per child beginning in tax year 2018 up from a maximum of 1000 per child through December 2017. Additional Child Tax Credit. This tax credit has helps millions of families every year and has been proposed to be expanded with the Trump Tax Reform.

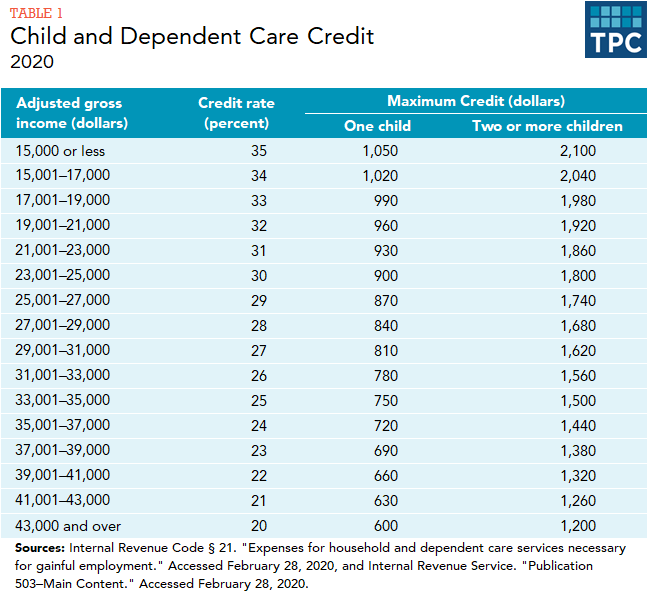

The credit amount is set at 2000 after the Tax Cuts and Jobs Act of 2017. For the 2020 tax year the Child and Dependent Care Credit can get you 20 to 35 of up to 3000 of child care and similar costs for a child under 13. The credits amount begins declining as you earn more.

Its been increased as part of the American Rescue Plan which was signed by President Biden in March 2021 as part of a US. What the new child tax credit means for your 2020 taxes Many families can receive up to 3000 or 3600 per child thanks to new changes to the child tax. For 2020 returns the ACTC is worth up to 1400.

Those who have a qualifying child under the age of 17 can claim the credit. The refund is capped at 1400. The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children.

The child tax credit is currently worth 2000 per qualifying dependent child. The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax. The 2020 Child Tax Credit Amount With tax reform the Child Tax Credit was increased to 2000 per qualifying child and will be refundable up to 1400 subject to income phaseouts.

You andor your child must pass all seven to claim this tax credit. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes. This is up from the prior 1000 amounts.

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

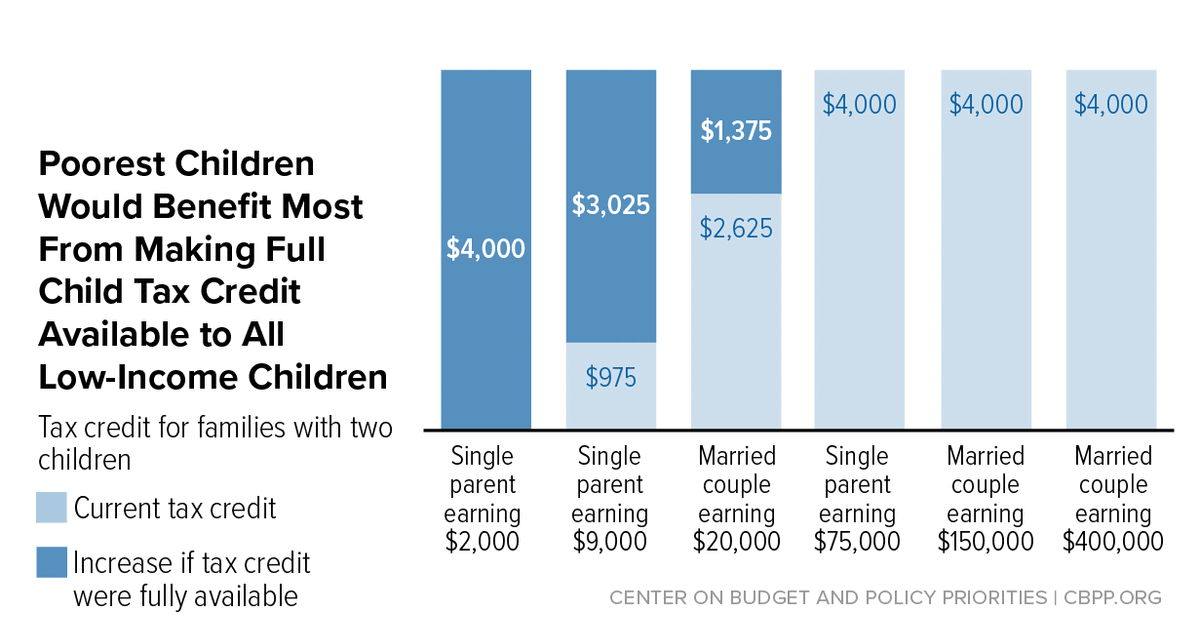

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

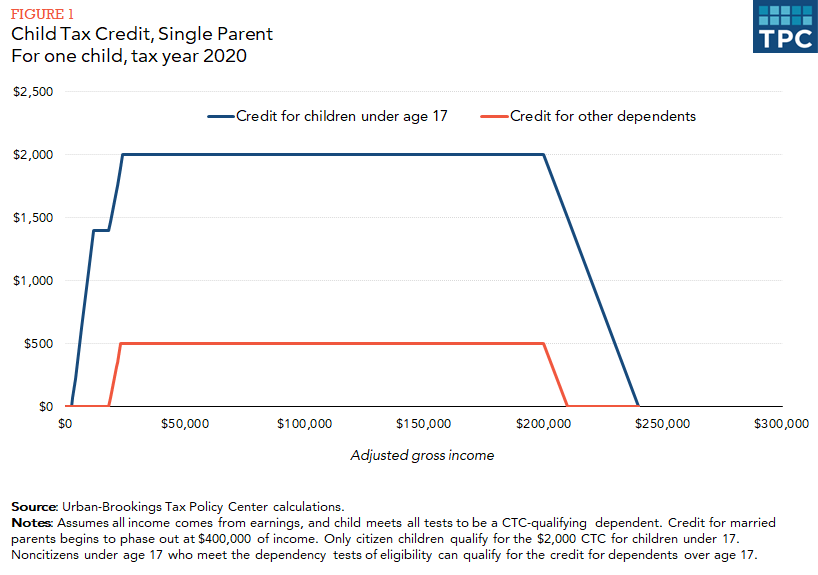

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

The Child Tax Credit Ctc A Primer Tax Foundation

The Child Tax Credit Ctc A Primer Tax Foundation

Donate To Arizona Tax Credit To Help Children Receive

Donate To Arizona Tax Credit To Help Children Receive

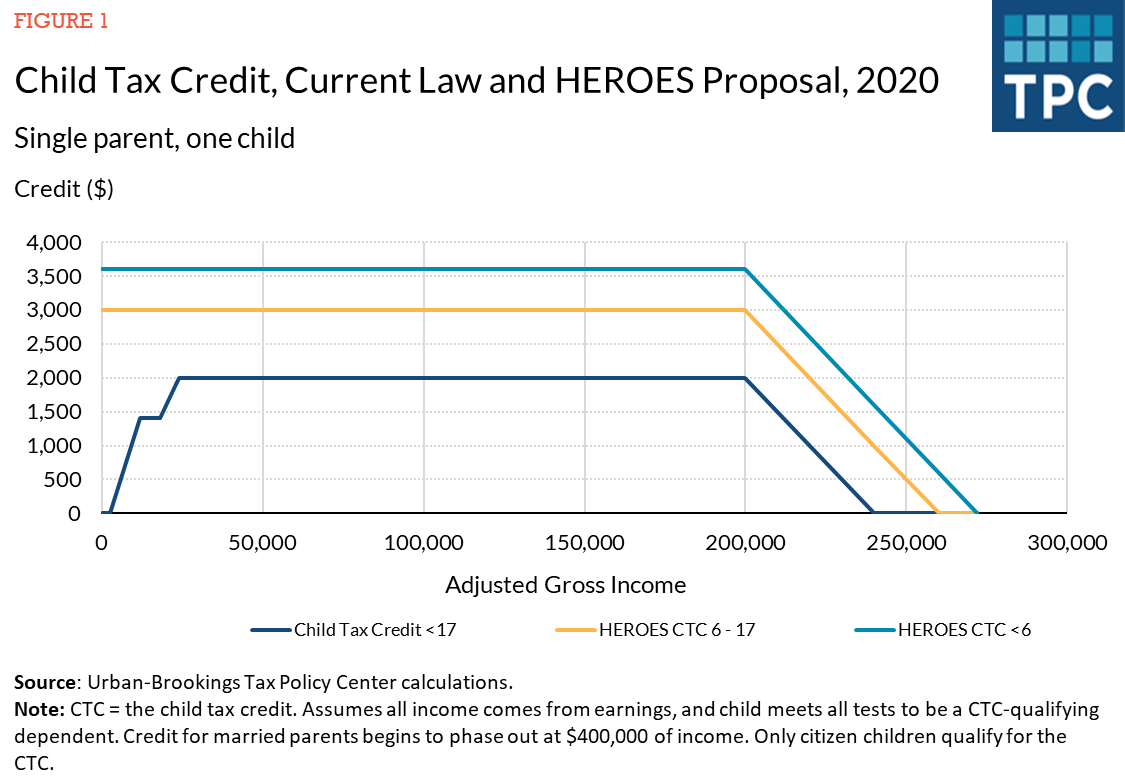

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

Child Tax Credit By Agi Ff 09 28 2020 Tax Policy Center

Child Tax Credit By Agi Ff 09 28 2020 Tax Policy Center

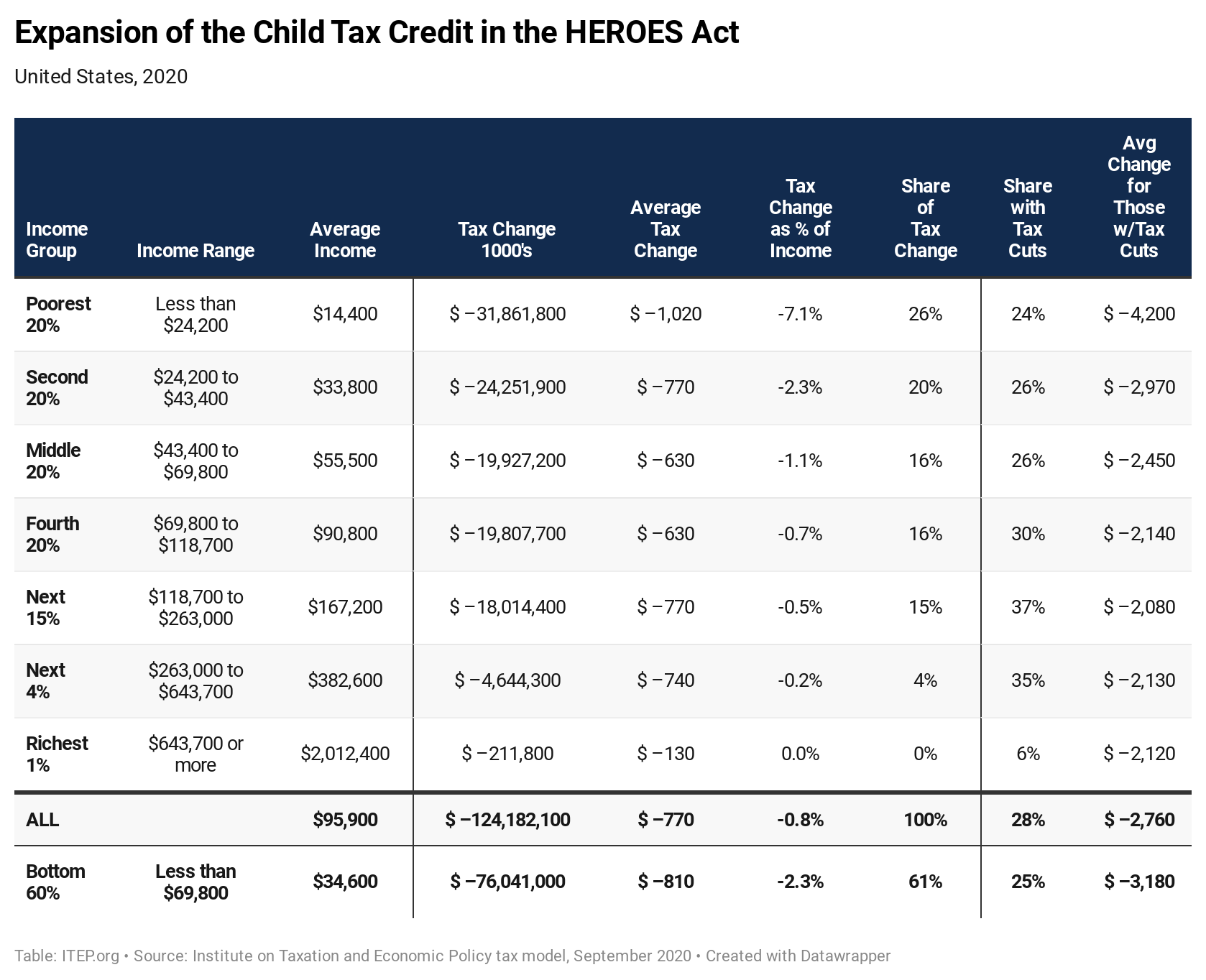

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

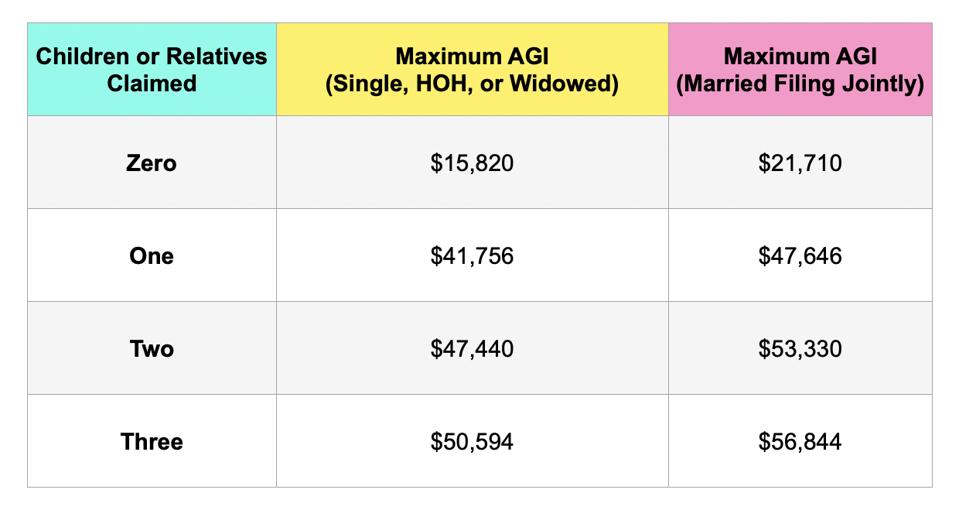

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Here S What You Need To Know About The Earned Income Tax Credit In 2021

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

How To File For Child Care Tax Credit

How To File For Child Care Tax Credit

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.