Credit and collateral are subject to approval. However the FDIC does not require the loan.

Bank Of America Mortgage Review Smartasset Com

Bank Of America Mortgage Review Smartasset Com

85 of that is 170000.

Home loan through bank of america. This insurance enables a lender to provide loan options and benefits often not available through conventional financing. Bank of America Programs. Its as good as most and better than many.

Bank of Americas home loan website is modern welcoming informative and easy to navigate. Programs include mortgage loan options with lower down payments. And affiliated banks Members FDIC and wholly owned subsidiaries of Bank of America Corporation.

Once youve made all trial payments on time well send you the Modification Agreement. You can get the following types of home loans through Bank of America. It also has branches in 36 states and DC.

FHA mortgage insurance protects the lender not the borrower if a borrower defaults on the FHA loan. The Modification Agreement defines the changes to your home loan. Were here to do everything we can to support your home loan needs at this time.

The Bank of America Payment Deferral Program is available for customers who currently have only one payment due on their loan. Through Bank of America you can generally borrow up to 85 of the value of your home MINUS the amount you still owe. This is commonly referred to as a HELOC.

We stand ready to support you. Bank of America Home Loans allows borrowers to apply for loan amounts of up to 5000000. If you still owe 120000 on your mortgage youll subtract that leaving you with the maximum home.

You can make payments through Online Banking by mail or over the phone. Terms and conditions apply. You may convert a withdrawal from your home equity line of credit HELOC account into a Fixed-Rate Loan Option resulting in fixed monthly payments at a fixed interest rate.

For example say your homes appraised value is 200000. The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is 5000 and the maximum amount that can be converted is limited to 90 of the. Its a similar story on Trustpilot where the bank has a 14 rating based on.

In general heres how it works. Its online mortgage service called Home Loan Navigator lets. Programs rates terms and conditions are subject to change without notice.

A home equity loan from Bank of America comes in the form of a home equity line of credit. This is not a commitment to lend. Mortgage loan originators go through very difference processes between federally chartered banks and mortgage companies.

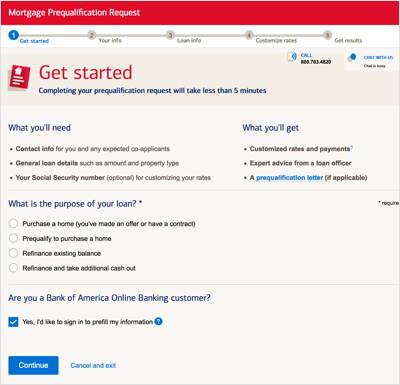

From the Bank of America mortgages website select Get Started. Also known as a government loan. Prospective buyers can prequalify to estimate how much they can borrow apply for a new mortgage refinance their current home and even lock their interest rate all on a mobile device or computer.

Were here for you with the home loan solutions support and advice you need. Fixed-Rate Loan Option at account opening. Home buying just got easier The Bank of America Digital Mortgage Experience puts you in control.

They also must be fingerprinted and checked for any criminal background. You can apply for a mortgage in person over the phone or online through the Bank of America Digital Mortgage Experience. Bank of America services loans in all 50 US states and Washington DC.

Bank of America offers an array of mortgage products including low-down payment solutions for first-time homebuyers and refinance loans with competitive rates. Banking credit card automobile loans mortgage and home equity products are provided by Bank of America NA. Find out how we can assist with your mortgage and home equity payments.

However it falls short in the customer service department earning slightly over a one-star rating from 405 customer reviews. Bank of America has been accredited with the Better Business Bureau BBB since 1949 boasting an A rating for its operations after closing almost 5500 customer complaints over the last three years. The application takes around 30 minutes to complete.

Bank of America is offering additional assistance to our clients through our enhanced Client Assistance Program which can provide payment deferrals or payment forbearances also known as a payment postponement. Well defer three payments and extend the term of your loan. Youll be asked if you want to Buy a Home or Refinance Your Existing Home.

How much can you borrow via Bank of America Home Loans. A mortgage home loan that is insured by the Federal Housing Administration FHA. To be a loan originator at a bank one needs to register with the National Mortgage Licensing System NMLS.

Shopping for a new mortgage or refinancing a current one is a streamlined experience with the Bank of America Digital Mortgage Experience. A HELOC works very similarly to a credit cardUnlike an installment loan where you borrow a fixed amount and make fixed payments over time a home equity line of credit allows you to add to the balance over time. Anyone with a history of financial crime such as fraud cannot practice mortgage origination.

Note that the maximum loan amount you can borrow will also vary depending on the type of mortgage you choose regardless of. We are committed to doing everything we can to support your home loan needs during this very challenging time. Well defer home loan payments for up to three months.

Your homes equity is the difference between the appraised value of your home and your current mortgage balance. You can get a. Prequalify to estimate how much you can borrow apply for a new mortgage or refinance your current home.