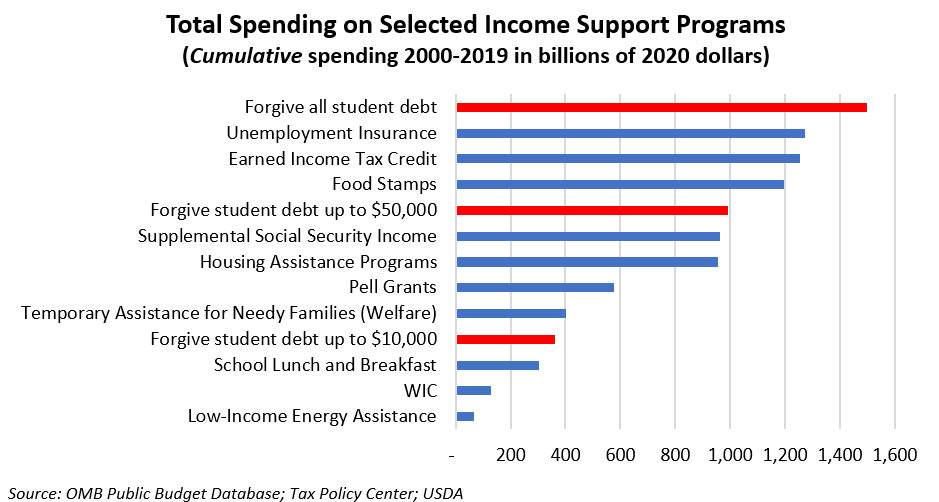

The amount of this forgiveness is referred to as the forgiven amount. Median student loan debt as a percentage of total before-tax income would decrease from 92 to 31 a 61-percentage point decrease.

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Much like other federal debts the IRS offers a forgiveness program to help taxpayers settle their debt without paying the full balance.

Federal income tax forgiveness of debt. Help with Federal Income Tax Forgiveness of Debt March 23 2020 The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. Debt forgiveness is when a creditor forgives some or all of your outstanding balance whether your debt is from credit cards federal student loans taxes or a mortgage. Our progressive tax system means that high-income households will pay more in taxes on the forgiven debt and a large amount of forgiveness could push a household into a higher tax bracket.

Dont automatically assume her forgiven debt is taxable however. Forgiveness of a shareholder loan. To escape tax your liabilities must exceed your assets by more than the amount of the debt discharged.

The difference between the FMV and your adjusted basis usually your cost will be gain or loss on the disposition of the property. Generally if you borrow money from a commercial lender and the lender later cancels or forgives the debt you may have to include the cancelled amount in income for tax purposes. And similar to income tax forms you will also receive a copy of the 1099-C forgiveness of debt form from the forgiving creditor in the tax year the final payment is made.

You must include this cancellation of debt in your income unless an exception or exclusion discussed below applies. This program is called the offer in compromise OIC. Under section 61 a 12 and section 161-12 of the Treasury regulations generally when debt is forgiven the taxpayer is taxable.

The lender is usually required to report the amount of the canceled. You also risk audits and penalties if you dont file Form 1099-C. That form will give you.

Some borrowers have decided against switching repayment plans to delay the. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. If youre facing this situation its possible to receive tax debt forgiveness if you can prove to the IRS that it was entirely your spouses fault and that they are the person whos entirely responsible for paying off the back tax debt.

Many low-income households do not pay federal income taxes and some receive refunds such as the earned income tax credit EITC. Your mother however should receive a Form 1099-C for the 10000. Say you have 1000 in assets and 2000 in liabilities so youre underwater to the tune of.

Your ordinary income from the cancellation of the debt is the amount of the debt in excess of the FMV of the property that the lender forgives. Perhaps the IRSs best-kept secret is that you can be forgiven of tax debt you owe but cannot pay. When the IRS considers forgiving your tax liability they look at your present financial condition first.

The IRS looks at your ability to pay income expenses and asset. 1 In general At the election of the taxpayer income from the discharge of indebtedness in connection with the reacquisition after December 31 2008 and before January 1 2011 of an applicable debt instrument shall be includible in gross income ratably over the 5-taxable-year period beginning with. For the wealthiest borrowers the 10000 forgiveness would result in a 34 percentage point decrease in median student loan debt as a percentage of total before-tax income.

Thats why the government offers IRS debt forgiveness when you cant afford to pay your tax debt. Generally if you borrow money from a commercial lender and the lender cancels or cancels the debt you may need to include the canceled amount in income for tax purposes. Do not include the forgiven debt on your tax return.

There are four programs of tax debt forgiveness and millions of people have used the programs I discuss in my book How to Get Tax Amnesty. Your forgiven debt could mean a big tax bill depending on your earnings deductions and other factors. Summarily the forgiven amount is calculated as the debts current principal amount minus amounts that are either paid on settlement or to the extent such amount would be otherwise included in the income of the debtor eg.

Although a borrower who is in an income-driven repayment plan for two decades is likely to qualify for forgiveness of the tax debt due to insolvency this is not guaranteed. Under certain circumstances taxpayers can have their tax debt partially forgiven. The IRS treats cancellation of debt like income on the borrowers federal income tax return substituting a tax debt for the education debt.

PROGRAM ONE - The Life Jacket. So if an individual borrows 100 and then the creditor forgives the debt the debtor generally has taxable income and has to pay tax on the 100 of forgiven debt.

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Irs Tax Debt Forgiven Thousands Reduce Their Debt Through This Program See If You Re Eligible Filing Taxes Tax Debt Irs Taxes

Irs Tax Debt Forgiven Thousands Reduce Their Debt Through This Program See If You Re Eligible Filing Taxes Tax Debt Irs Taxes

What Is The Irs Debt Forgiveness Program Tax Defense Network

What Is The Irs Debt Forgiveness Program Tax Defense Network

How To Report Debt Forgiveness 1099c On Your Tax Return Robergtaxsolutions Com

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

2020 Guide To The Irs Tax Debt Forgiveness Program Forget Tax Debt

2020 Guide To The Irs Tax Debt Forgiveness Program Forget Tax Debt

Irs Form 982 Is Your Friend If You Got A 1099 C

Irs Form 982 Is Your Friend If You Got A 1099 C

The Fuse Hidden Costs How Forgiveness Of Student Debt Could Reduce Vehicle Ownership The Fuse

Got Debt Then You May Be In For Some Unwelcome Tax Surprises Abc27

Got Debt Then You May Be In For Some Unwelcome Tax Surprises Abc27

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Irs Taxes Most Loan Forgiveness Be Careful With Exceptions

Irs Taxes Most Loan Forgiveness Be Careful With Exceptions

What Is The Irs Debt Forgiveness Program Tax Defense Network

What Is The Irs Debt Forgiveness Program Tax Defense Network

Understanding The Tax Implications Of Student Debt Forgiveness Urban Institute

Understanding The Tax Implications Of Student Debt Forgiveness Urban Institute

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.