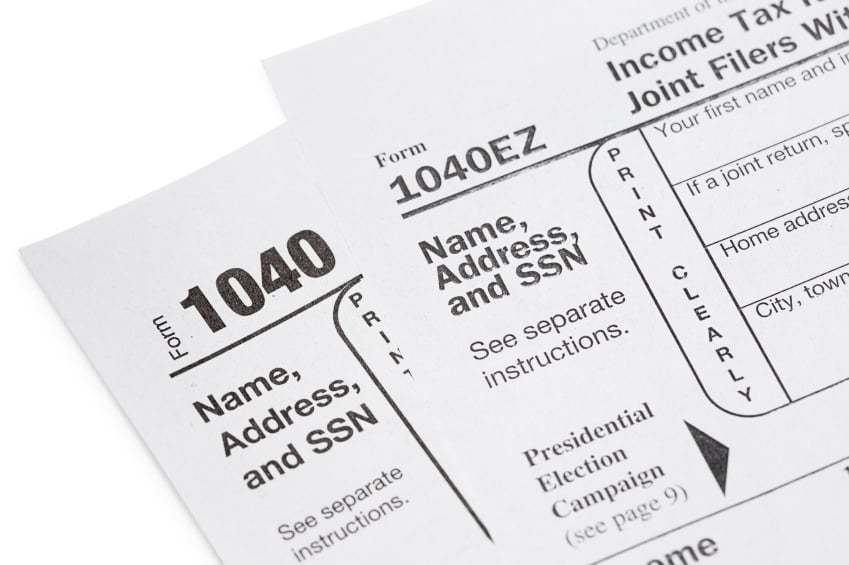

For example with refunds going into your bank account via direct deposit it could take an additional five days for. Get an income tax package.

/tax-documents-to-the-irs-3973948-v1-c43621daf8d548328ec95b4f53fd75ff.png) How To Mail Your Taxes To The Irs

How To Mail Your Taxes To The Irs

The date you get your tax refund also depends on how you filed your return.

How can i get tax return. Log in to Inland Revenue to see if you have a refund. A separate Form IL-4506 must be completed for each tax type requested. How to File a Simple Tax Return in 5 Steps.

You can get an income tax package guide return and schedules for your province or territory either online or by mail. There are ways to boost the tax refund you get back from the government. You can easily file a tax return in just a few minutes that gives the IRS the information it needs to get you your payment.

The fee per copy is 50. As per the Income Tax Act a person is required to file hisher return in the relevant assessment year by July 31 unless deadline extended to claim the refund. If youre really trying to get the biggest refund you can make sure that you use the best tax filing software you can.

Get a SingPass or IRAS Unique Account IUA SingPass is a common password that you can use to access all Government e-Services. When to File Income Tax Return. Scroll down to the bottom and select Your tax returns documents.

To order your tax return transcript by mail. For example you can do your tax return in Germany for the year 2020 until the last day of 2024. If the year youre looking for isnt there it might be in a different account.

Even your filing status can get you a bigger refund. If there is no View button on the period you need you must request a paper copy. Enter your PIN Type of return return period From and return period To The 1 st date of January Last year to the last date of December Last year.

Select the year you want then select Downloadprint return PDF. Depending on the complexity of your tax return you could get your tax refund in just a couple of weeks. Mail the request to the appropriate IRS office listed on the form.

You should have received most of your slips including your T4 T4A and T5 slips and receipts by the end of February. A person can claim the refund of the excess tax paiddeducted during a financial year by filing his or her income tax returns for that year. A tax credit is a dollar-for-dollar reduction of the tax you owe and a refundable tax credit will allow you to have a credit beyond your tax liability.

2-Step Verification or 2FA is required when you use SingPass. You can also order by phone at 800-908-9946 and follow the prompts. Heres how to get a transcript.

For individuals who have mixed-income or are self-employed the ITR Form that you will need to accomplish is BIR Form 1701. If you would like a paper copy of your tax return and any attachment to that return from the Department you must complete Form IL-4506 Request for Copy of Tax Return. People who live in a federally declared disaster area can get a free copy.

Select the tax obligation Income Tax-Resident Individual and click Next Click to download the Income Tax Return form using the provided link. Pretty handy if you forgot to do it those years to maximize return. You can apply for SingPass online and you should receive it within four working days.

Slips are prepared by your employer payer or administrator. Nominate a bank account where IR can deposit your refund. If youre self-employed or get income from somewhere not listed above you need to.

Complete my individual tax return IR3 Check if you have a refund. Sign back in to your account and scroll down and select Amend change return You will not be amending this is just a way to get you back into your tax return Select Amend using TurboTax Online. To get a timeline for when your refund will arrive you can go to wwwirsgovrefunds.

Check your contact information is correct. As an employee you can claim a tax return for up to 4 years prior the current year. Its all about optimizing your deductions claims and credits.

Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years. The fastest way to get a Tax Return or Account transcript is through the Get Transcript tool available. Youre just going to have to provide some basic info and its stuff you know said Logan Allec a CPA and owner of the personal finance site Money Done Right.

Choose your province or territory. Go here to find all of your accounts one. An income tax return ITR is a form that taxpayers file with the BIR to report their income expenses and other important information such as tax liability and any refund for excess payment of taxes.

Complete and mail Form 4506 to request a copy of a tax return. However T3 and T5013 slips do not have to be sent before the end of March. A good tax service will help you get every deduction and credit that you qualify for.

You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return or four weeks after mailing your paper return if youre old school. Here are the steps to print your return and all forms and worksheets. To get your OAS EI.