Finally you will enter a variety of demographic information as directed. Signed affidavits from persons verifying the individuals self-employment.

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Click on Federal Taxes Personal using Home and Business Click on Wages and Income Personal Income using Home and Business Click on Ill choose what I work on if shown Under Unemployment.

How to add unemployment to taxes. Remember to keep all of your forms including any. Heres how to avoid a surprise tax bill. UI Submission Portal.

Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form. Unemployment benefits are typically treated as taxable income on your federal tax return. Important tax planning notes.

If you have more than one 1099-G form add all the amounts from Box 1 on each form and enter the total amount. TWC provides this quick free online service to make registering. Use Form W-4V to withhold any tax from your unemployment income or pay quarterly taxes to ensure you dont owe the government any penalties come tax season.

Fill out Schedule 1 like you normally would and report the unemployment compensation earned during 2020. Is unemployment income taxable. Unemployment benefits are typically treated as taxable income on your federal tax return.

Acceptable proof of prospective employment includes one of the following. Logon to Register for a New Unemployment Tax Account. On Unemployment and Paid Family Leave click the start or update button.

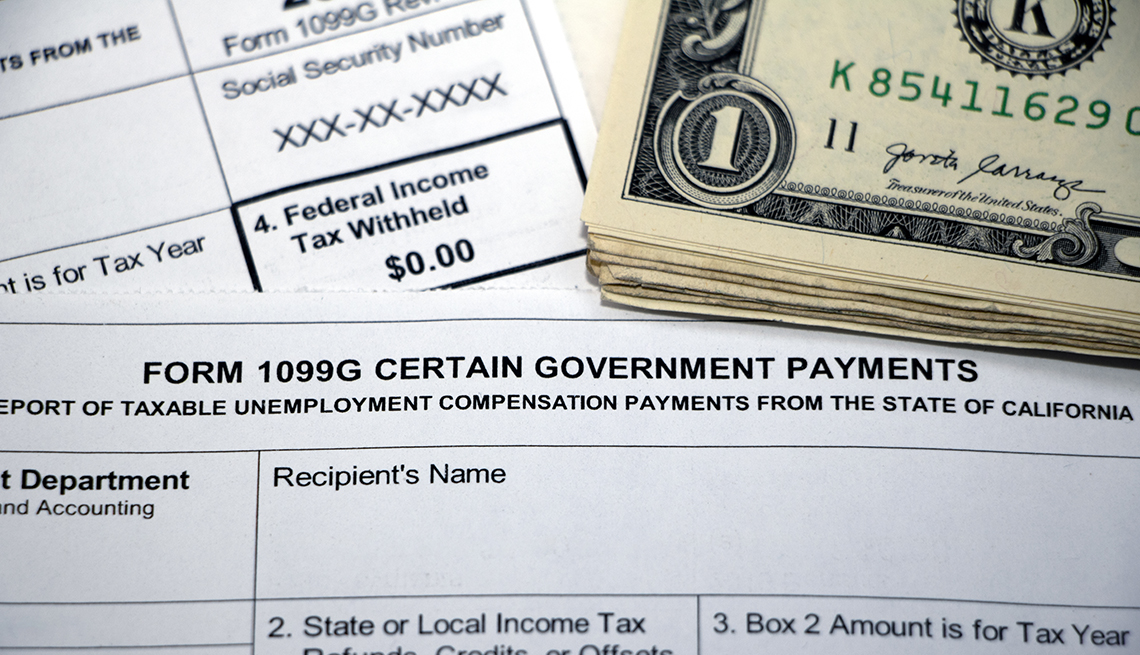

If TWC asked you to provide unemployment insurance UI documents you can upload them using our online UI Submission Portal. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. You will then add your phone number including your mobile phone home phone or any alternative phone number you may have.

Refer to Form W-4V Voluntary Withholding Request and Tax Withholding. The exclusion will be applied automatically based on the entries in the program. The amount will be carried to the main Form 1040.

If youre wondering if unemployment is taxed the answer is yes. How do you add unemployment income to your federal taxes. Form 1099-G Box 1 Unemployment Compensation.

Unemployment compensation is usually taxed in Delaware. And always consider working with a tax professional if you have questions about your specific situation. May be required to make quarterly estimated tax payments or Can choose to have federal income tax withheld from your unemployment compensation.

WROC Unemployment income is taxable and needs to be included on your 2020 tax return if you received the benefit last year. Using Unemployment Tax Registration. On your 1099-G form Box 1 Unemployment Compensation shows the amount you received in unemployment wages.

But the 19 trillion American Rescue Plan which President Joe Biden signed into law in mid-March waived federal tax on up to 10200 of unemployment benefits per person. You can then use the Unemployment Compensation Exclusion Worksheet to figure out the amount youre eligible to waive from taxable income. You will need to input your personal information on the portal then select the type of submission you want to.

You will then be able to enter your employment history resume and. Unemployment benefits are subject to both state and federal income taxes but its not always straightforward. However unemployment benefits received in 2020 are exempt from tax.

Statementsaffidavits by individuals with name and. If this amount if greater than 10 you must report this income to the IRS. You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section.

If you received a Form 1099-G for unemployment compensation that you received during the year you can enter this in your account go to. CPA Matt Bryant explained what you need to know Thursday during News 8 at Sunrise. Employers must register with the Texas Workforce Commission TWC within 10 days of becoming subject to the Texas Unemployment Compensation Act.

Here is how to claim the unemployment tax waiver. Proof of Prospective Employment. At this point you have completed the initial registration with your account.

Add or Edit a 1099-G. But the 19 trillion American Rescue Plan which. Logon with your existing TWC User ID or create a new User ID.

The amount that was withheld will appear in Box 4 if you asked to have income tax withheld from your benefits. Reporting unemployment benefits on your tax return. Yes unemployment income is taxable by both the IRS and New York State.

The amounts you receive should be reflected on your taxes on Form 1040 technically you will report not file unemployment on your taxes. How to file unemployment on your taxes. Income tax return for the applicable tax year must include the IRS Tax Form 1040 and schedule C F or SE.

State Taxes on Unemployment Benefits. If you received unemployment compensation you. To enter unemployment compensation.

This will enable you to waive the majority of your unemployment. The following TurboTax FAQ will guide you as to where to enter your 1099-G for unemployment. State Income Tax Range.

Income - Select My Forms. These benefits are subject to both federal and state income taxes.

/faidleys-crab-cake-58755a783df78c17b6d9042f.jpeg)