In 1996 the IMF and World Bank launched the Heavily Indebted Poor Countries Initiative. The policy brief entitled Liquidity and Debt Solutions to Invest in the SDGs takes stock of the global policy response since April last year assess remaining gaps and challenges for their implementation as well as propose updates to the recommendations presented last year in light of developments over the past 12 months.

Shrugging Off Debt Relief Initiatives Developing Countries Continue Tapping Global Debt Markets To Plug Covid 19 Financing Needs Enterprise

Shrugging Off Debt Relief Initiatives Developing Countries Continue Tapping Global Debt Markets To Plug Covid 19 Financing Needs Enterprise

Debt relief Multi-lateral debt relief.

Global debt relief. The coronavirus pandemic has placed significant strain on already-weak healthcare systems in developing countries putting millions of lives at risk both at home and abroad. Our technology platform and expert services have enabled the implementation of debt. Global Holdings is a financial technology company that has been providing payment processing and account management services to the debt settlement industry for nearly 20 years.

Beyond debt relief long-term debt sustainability requires efforts by borrowers lenders and donors to promote prudent borrowing suitably. Spectacular state bankruptcies like that of. We also work to ensure that your creditors dont harass you at your home or place of business.

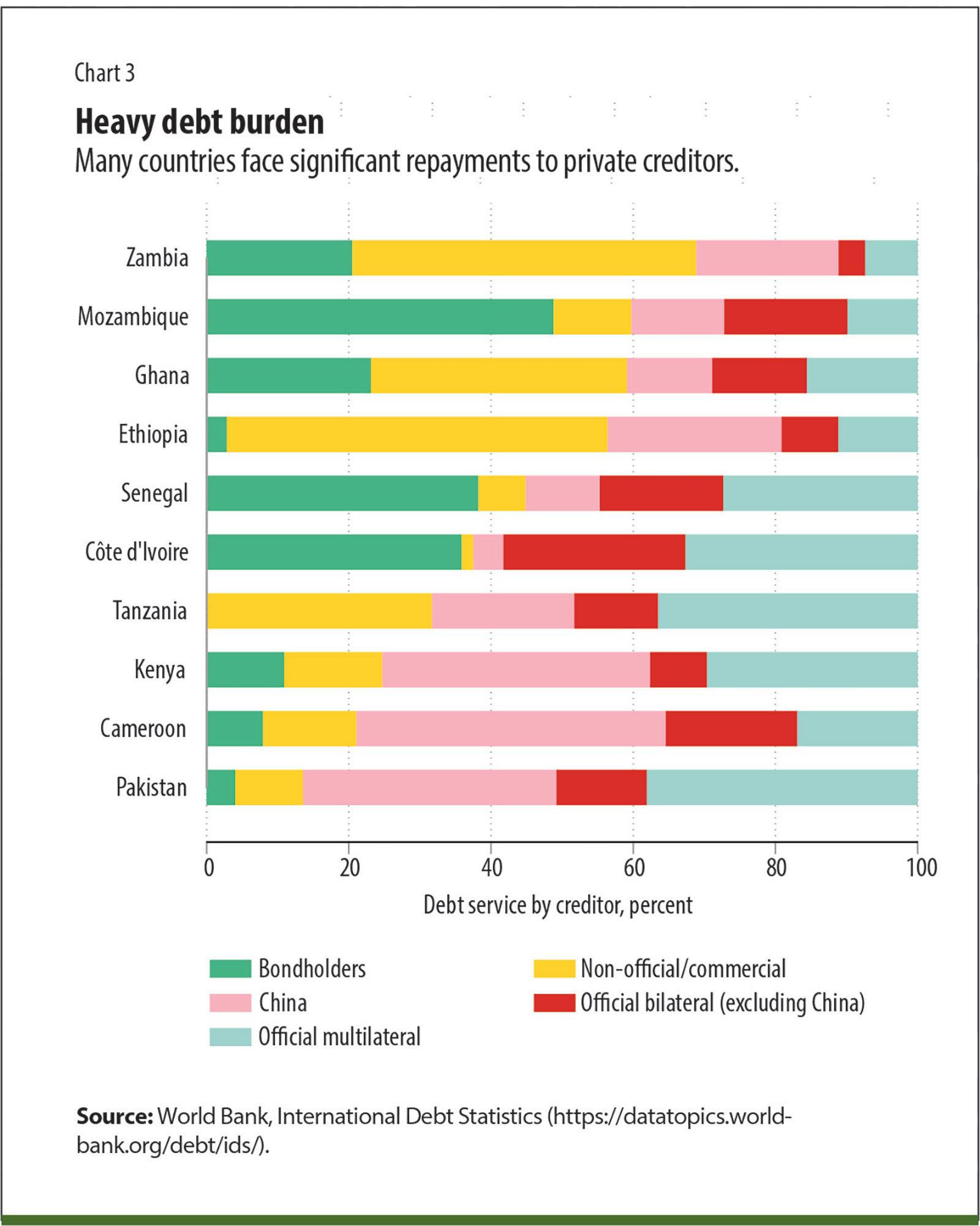

Challenges remain to ensure that debt burdens do not return to unsustainable levels however. The Paris Club which is exclusively for country-to-country debt restructuring is a group of 20. A UK-led health and green debt initiative would offer debt relief to the worlds poorest nations freeing up vital funds to pay for vaccinations and.

We offer FTC-compliant performance based debt relief. A global debt crisis today will push millions of people into unemployment and fuel instability and violence around the world. Well talk more about what we do -.

We are a team of financial experts dedicated to helping people understand and overcome their debt. The Global Souths debt trap. The clock is ticking.

The idea of a. There is an imbalance in the global debt system that puts sovereign debt in a unique category that favours creditors over the people in the borrowing country theres not a sovereign bankruptcy process that allows for partial payment and reduction of claims. Global DS Group is a leader in the debt relief industry.

Debt relief or debt cancellation is the partial or total forgiveness of debt or the slowing or stopping of debt growth owed by individuals corporations or nations. The case for debt forgiveness. In a new report the Global Development Policy Center outlines an ambitious new proposal for comprehensive debt relief that includes the private sector and middle-income countries in an effort to jump start a green and inclusive recovery from COVID-19The report summarized below is produced in partnership with the Heinrich Böll Stiftung and.

Debt Relief for a Green and Inclusive Recovery. Need for debt relief. The global debt clock.

As the debt relief initiatives have matured the international community has focused on strengthening the links between debt relief and poverty-reduction efforts. Debt relief would provide low-income countries fiscal leeway to rebuild their economies. We look forward to working with you to achieve the best result possible.

Cheap money and low interest rates in Europe and the US drew lots of investment to the South creating unprecedented levels of debt there. From antiquity through the 19th century it refers to domestic debts in particular agricultural debts and freeing of debt slaves. At Global DS Group we always have our customers best interest at heart and are not afraid to base our fees on performance.

Our interactive overview of government debt across the planet. Global Debt Relief and a Green Recovery. The IMF expects fiscal balances.

National Debt Relief is a BBB-accredited New York-based business with a host of awards and accolades. PM advocates global debt relief initiative for developing countries Thats only after immediately redirecting all the remainder of the 4 of GDP defense spending to. Global public debt stocks are projected to jump by 13 percentage points of gross world product in just one year from 83 to 96 per cent IMF Fiscal Monitor 2020.

Every second it seems someone in the world takes on more debt. We specialize in consolidating the balances on credit card debts medical bills repossessions certain business debts and other unsecured obligations. As a result people even the worlds poorest and most destitute are required to pay their governments debts as long as.

In the late 20th century it came to refer primarily to Third World debt which started. The Global South is overburdened by debt. Many will seek jobs abroad potentially overwhelming border-control.